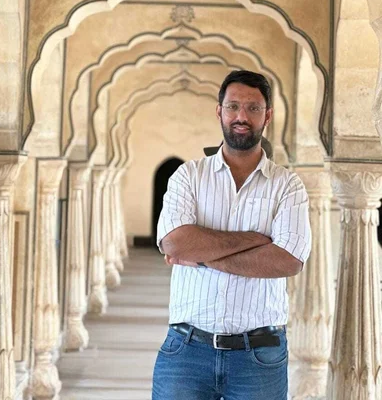

Behind every fast-growing fintech lies a strong foundation of trust, and trust begins with compliance. For Stanford Cardoz (EMBA 2015), that’s more than a job description, it’s a career calling. From guiding one of the UAE’s first regulated crypto exchanges to now shaping the compliance strategy at Robinhood MENA, Stanford has been at the forefront of balancing innovation with responsibility. His story is not just about keeping pace with regulation, but about using it as a catalyst for growth. In this interview, he reflects on his journey, the challenges of leading in a rapidly changing sector, and how his SP Jain Global EMBA equipped him to bridge governance with innovation.

1. Could you briefly share your career journey and what brought you to your current role?

My journey has been rooted at the intersection of compliance, financial services, and innovation. I began my career in traditional banking, but quickly pivoted into the world of fintech and virtual assets, recognising their transformative potential. I served as VP of Compliance at BitOasis, one of the first regulated crypto exchanges in the UAE. I worked closely with regulators like VARA to shape crypto compliance frameworks from the ground up. That experience solidified my belief in proactive, regulation-first growth for fintechs. Today, I serve as Chief Compliance Officer for Robinhood MENA, leading compliance strategy for a firm redefining access to global financial markets for the region.

2. You recently took charge as Chief Compliance Officer for MENA at Robinhood. What were your first priorities as Chief Compliance Officer at Robinhood MENA?

My priority has been laying a strong regulatory foundation — securing our DFSA license in the DIFC with a retail endorsement, and building frameworks that allow us to offer a wide range of products, from US equities to crypto. We’re taking a phased approach to growth: ensuring that governance, risk, and compliance functions are robust and enable speed and innovation. I’ve also focused on building our vendor stack—partnering with industry leaders like Chainalysis and Notabene—to enhance blockchain surveillance, IDV, and travel rule compliance from day one.

3. How does Robinhood’s mission to democratise investing align with your compliance values?

Democratising finance requires trust, and trust is built through compliance. My role is to ensure that while Robinhood expands access to investment products, we do so responsibly and within clear regulatory guardrails. I believe in making compliance a competitive advantage, not a bottleneck. My values align with Robinhood’s mission by helping reduce friction for retail investors while embedding risk controls and transparency throughout the journey.

4. The MENA fintech sector is booming but faces rapid regulatory changes. How do you stay ahead of fast-changing regulations in MENA’s fintech sector?

Staying ahead requires constant engagement with regulators and the broader compliance ecosystem. I serve on advisory boards, speak at regional panels, and maintain active dialogue with rule-making bodies like VARA, the DFSA, and the FSRA. Internally, we embed risk ownership across functions and cultivate a culture where compliance is seen as a shared responsibility. For fast-moving areas like crypto or data privacy, we don’t just react—we anticipate. We invest in modular policies that evolve with regulation.

5. Having worked across various jurisdictions, how do you build a compliance culture that supports innovation?

It starts with tone from the top and a clear mandate: compliance is a strategic partner, not a check-the-box function. I emphasise early-stage engagement—working with product and tech teams from the design phase—to ensure we’re compliant by design. I also advocate for continuous learning: translating regulatory expectations into business context so teams are empowered, not constrained. The key is fostering a culture that values both innovation and accountability.

6. What advice do you have for aspiring compliance or fintech leaders in emerging markets?

Own your curiosity and be regulatory-native. Emerging markets offer unique challenges but huge opportunities for those willing to bridge regulation with innovation. My advice: build strong fundamentals, stay informed, and never underestimate the value of relationships with regulators, peers, and mentors. Compliance leadership today isn’t about saying “no” but finding the safest path to “yes.”

7. How did your Executive MBA experience at SP Jain Global shape your professional outlook or leadership style?

The EMBA at SP Jain Global helped me crystallise the link between operational strategy and compliance. It taught me to think across functions—balancing governance with growth. The global exposure, particularly the regional immersions and cross-border case studies, helped me better understand risk in a multi-jurisdictional environment. More importantly, it gave me the confidence to lead transformation, not just manage it.

8. Were there any courses or experiences at SP Jain Global that particularly shaped your career?

Yes—Professor Dr Christopher Abraham’s innovation and strategic leadership sessions were particularly impactful. I also vividly remember a module on international business strategy where we simulated regulatory responses in emerging markets. That experience directly shaped how I approach regulatory engagement today. Beyond academics, the peer network—interacting with leaders from diverse industries—broadened my worldview and gave me invaluable insights.

Want to see where an SP Jain Global degree can take you? Discover more alumni success stories here.